Affordable SR22 Insurance in Dallas with Texas Best Policy Store

With a growing population in Dallas, traffic violations have surged, making SR22 insurance increasingly essential. More vehicles on Dallas roads mean more violations, which has increased the need for SR22 coverage. Know more about cheapest sr22 insurance

SR-22 insurance is not a standard policy but a certificate proving financial responsibility. It is required for individuals deemed high-risk by the state authorities. While it’s not an insurance policy, SR22 guarantees coverage compliance.

Dallas has seen a rise in SR-22 insurance needs as accidents and citations climb. The Texas DMV reports a record number of high-risk drivers needing SR22 filings.

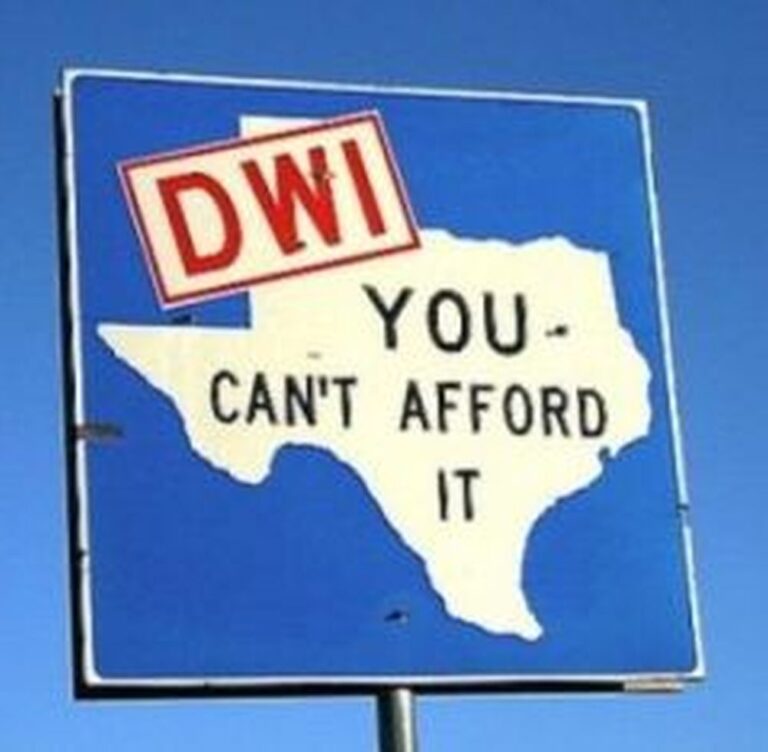

SR22 insurance explained: why Dallas drivers need it. The SR-22 filing is proof of auto insurance for high-risk drivers. If you’ve had a license suspension or DUI, you need an SR22 filing. Visit this page for details: www.policy-store.com.

Who needs SR22 insurance in Dallas? Drivers with serious traffic incidents, license suspensions, or excessive points may need it.

SR22 duration in Dallas explained. The Texas DMV usually requires SR22 filings for 1-3 years.

Can I get an SR22 from any insurance company? It’s important to choose a provider familiar with SR22 requirements. Check availability at https://www.policy-store.com/.

Non-owner SR22 insurance is available if you don’t own a vehicle.

Failure to maintain SR22 can suspend your driving privileges.

The filing process can take a few business days depending on the insurer.

SR22 insurance transfers when relocating to Texas.

High-risk drivers in Dallas, TX can get quotes easily. You can look here: www.policy-store.com.

Remember, SR22 insurance ensures compliance and financial responsibility.